Payment systems are the backbone of modern economies, enabling transactions between individuals, businesses, and governments. However, traditional payment systems face scalability, security, and speed challenges. In this article, researchers from the University of Waterloo and the Bank of Canada explore the potential of quantum computing to revolutionize payment systems. By leveraging the power of quantum computers, they propose improving transaction processing speed, security, and scalability. But what are the challenges and implications for financial institutions? Read on to find out how quantum computing can transform how we make payments.

Can Quantum Computing Revolutionize Payment Systems?

The article “Improving the Efficiency of Payments Systems Using Quantum Computing” by Christopher McMahon et al. explores the potential of quantum computing to enhance payment systems. The authors, from the University of Waterloo and the Bank of Canada, investigate how quantum computing can improve the efficiency of payments systems.

What is the Current State of Payment Systems?

Payment systems are a crucial part of modern economies, enabling transactions between individuals, businesses, and governments. However, traditional payment systems face challenges such as scalability, security, and speed. The current state of payment systems relies on classical computing, which can be slow and inefficient for large-scale transactions.

How Can Quantum Computing Help?

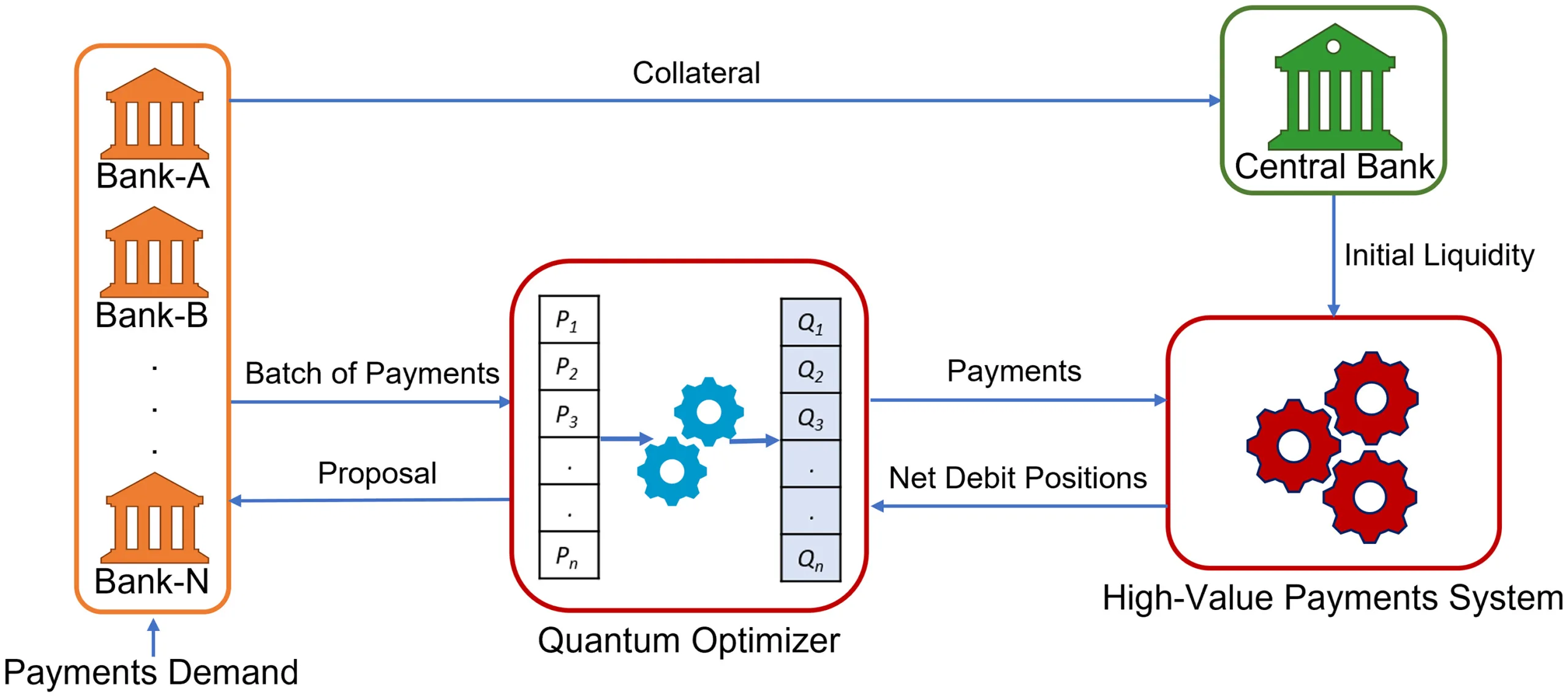

Quantum computing has the potential to revolutionize payment systems by providing a new paradigm for processing transactions. Quantum computers can perform calculations exponentially faster than classical computers, making them ideal for complex financial transactions. The authors propose using quantum computing to improve the efficiency of payments systems in several ways:

- Faster Transaction Processing: Quantum computers can process transactions much faster than classical computers, reducing the time it takes to settle payments.

- Improved Security: Quantum computers can generate and verify cryptographic keys more efficiently, enhancing the security of payment transactions.

- Enhanced Scalability: Quantum computing can handle large-scale transactions with ease, making it an attractive solution for high-volume payment systems.

What are the Challenges?

While quantum computing holds great promise for improving payment systems, there are several challenges to overcome:

- Quantum Noise: Quantum computers are prone to errors due to quantum noise, which can affect the accuracy of calculations.

- Scalability Limitations: Currently, quantum computers are limited in their scalability, making it challenging to apply them to large-scale transactions.

- Interoperability: Integrating quantum computing with existing payment systems requires significant interoperability efforts.

What is the Future Outlook?

The authors conclude that quantum computing has the potential to revolutionize payment systems, but more research and development are needed to overcome the challenges. The future outlook for quantum computing in payments depends on advancements in quantum error correction, scalability, and interoperability.

Can Quantum Computing Replace Classical Computing?

While quantum computing can improve the efficiency of payment systems, it is unlikely to replace classical computing entirely. Quantum computers will likely be used as a complementary technology to enhance specific aspects of payment systems, such as transaction processing speed or security.

What are the Implications for Financial Institutions?

Financial institutions that adopt quantum computing in their payment systems may gain a competitive advantage by offering faster and more secure transactions. However, this also raises concerns about the potential impact on employment and the need for retraining in emerging technologies.

The article “Improving the Efficiency of Payments Systems Using Quantum Computing” highlights the potential of quantum computing to revolutionize payment systems. While there are challenges to overcome, the authors demonstrate that quantum computing can improve transaction processing speed, security, and scalability. As the technology continues to evolve, it is essential for financial institutions and policymakers to stay informed about the implications of quantum computing in payments.

Publication details: “Improving the Efficiency of Payments Systems Using Quantum Computing”

Publication Date: 2024-07-12

Authors: Christopher McMahon, Donald McGillivray, Ajit Desai, Francisco Rivadeneyra, et al.

Source: Management Science

DOI: https://doi.org/10.1287/mnsc.2023.00314